|

1996 TAXABLE SALES IN THE SAN FERNANDO VALLEY |

1996 TAXABLE SALES IN THE SAN FERNANDO VALLEY

Special Study - State Board of Equalization

Taxable sales for the San Fernando Valley are estimated as follows:

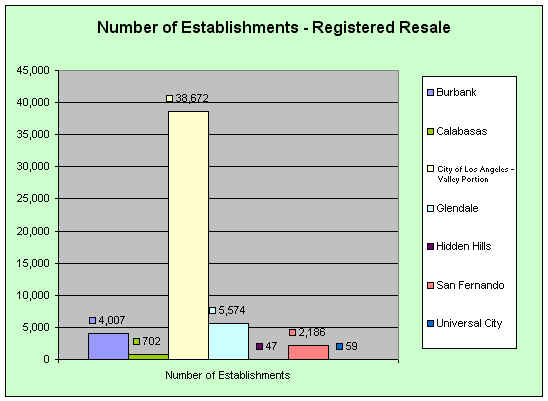

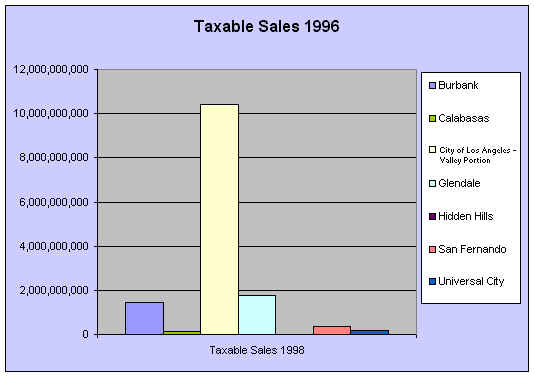

Locations |

Number of Establishments |

Taxable Sales 1996 |

Burbank |

4,007 |

$1,465,410,000 |

Calabasas |

702 |

148,520,000 |

City of Los Angeles – Valley Portion |

38,672 |

10,430,525,100 |

Glendale |

5,574 |

1,781,655,000 |

Hidden Hills |

47 |

2,165,000 |

San Fernando |

2,186 |

349,698,000 |

Universal City |

59 |

171,576,500 |

Total |

51,247 |

$14,349,549,600 |

Text of Special Report

Considerable interest has been expressed recently in the economy and sales tax base of the San Fernando Valley in general, and the portion of that area in the city of Los Angeles in particular. As a result of that interest the Board of Equalization has conducted a special study of the area. The Board routinely tabulates taxable sales by city and county, a byproduct of administering local sales taxes. However, sales within particular areas of a given city or the unincorporated area of a county are not normally totaled, since 1) such totals are not needed for administration of the local taxes and 2) breakdowns are no reported by some sales tax accounts. Consequently, tabulating sales for this area required a special study.

There are no definitive boundaries for the San Fernando Valley, and perceptions of which particular subareas comprise the total area may vary. For purposes of this study the San Fernando Valley was considered to consist of the following subareas:

The portion of the city of Los Angeles lying generally north of a line following Mulholland Drive to Cahuenga Blvd. to Barham Blvd. to the city limits of Burbank. (This is the line described in Section 11093 of the Government Code of the State of California.)

The Universal City portion of the unincorporated area of Los Angeles County.

The cities of Burbank, Calabasas, Glendale, Hidden Hills, and San Fernando.

The study was based primarily on sales activity during calendar year 1996. Businesses open for just a portion of that period were adjusted to reflect the tax that would be expected from an entire year's activity.

Taxable sales for the entire City of Los Angeles in calendar year 1996 were $24,906,839,000. That total and the above figure for the portion of the city in the San Fernando Valley are not completely comparable, since the businesses in the San Fernando Valley open less than a full year were adjusted to estimate a full year's activity. However, since that does not greatly affect the comparability, one can reasonably estimate the portion of the total taxable sales in the city of Los Angeles attributable to businesses in the San Fernando Valley to be $10,430,525,100/$24,906,839,000 = 41.9%.

The total sales and use tax rate in the city of Los Angeles is 8.25%. That rate is comprised of separate rates generating revenue for the state, county, city, and special districts. The component of the tax rate directly generating revenue for the city is 1%. In 1996 the total sales tax in the city generated at the 1% rate was $249 million, with $104 being attributable to sales in the San Fernando Valley.

The total population of the city of Los Angeles as of January 1, 1997 was 3,681,700. The San Fernando Valley portion of the city amounted to 1,264,800, or 34.4% of the total city.

Questions regarding this material may be directed to Jeff Reynolds at (916) 445-0840.

Statistics Section

Agency Planning & Research Division

State Board of Equalization

January 2, 1998